Reference dates for which conversion factor is computed (usually the first day of delivery months), specified as an N-by-1 vector of serial date numbers.

Data Types: double

Maturity date, specified as a N-by-1 vector of serial date numbers.

Hull 200 69 Cheapest to deliver bond Any of a range of eligible bonds can be from FINANCE MISC at University of Warwick.

Conversion Factor Bond

Data Types: double

CouponRate — Annual coupon rates for underlying bond

vector in decimals

- Deliverable Bonds and Conversion Factors for all Fixed Income Futures at a glance Download 14 Dec 2020. Notified Bonds for all Fixed Income Futures at a glance.

- Conversion factor tables for U.S. Treasury Bond and Note futures have been updated to include conversion factors for the following securities: 1/8s of Jan 2024 (a new 3-year note) 7/8s of Nov 2030 (a reopened 10-year note) 1-5/8s of Nov 2050 (a reopened 30-year bond) The 3-year note is eligible for delivery into: 3-Year futures contract for Mar 21.

Annual coupon rates for underlying bond, specified as an numBonds-by-1 vector in decimals.

Data Types: double

Name-Value Pair Arguments

Specify optional comma-separated pairs of Name,Value arguments. Name is the argument name and Value is the corresponding value. Name must appear inside quotes. You can specify several name and value pair arguments in any order as Name1,Value1,...,NameN,ValueN.

CF = convfactor(RefDate,Maturity,CouponRate,'Convention',2)'Convention' — Conversion factor convention

1 US Treasury bond (30-year) and Treasury note (10-year) futures contract (default) | integer from 1 to 5

Conversion factor convention, specified as the comma-separated pair consisting of 'Convention' and a N-by-1 vector using the following values:

1= US Treasury bond (30-year) and Treasury note (10-year) futures contract2= US 2-year and 5-year Treasury note futures contract3= German Bobl, Bund, Buxl, and Schatz4= UK gilts5= Japanese Government Bonds (JGBs)

Data Types: double

'FirstCouponDate' — Irregular first coupon date

serial date number

Irregular first coupon date, specified as the comma-separated pair consisting of 'FirstCouponDate' and a N-by-1 vector using a serial date numbers.

Data Types: double

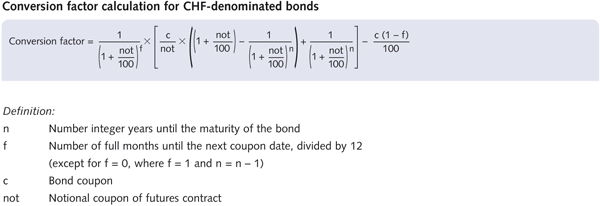

Conversion Factor Definition

'RefYield' — Reference semiannual yield

0.06 (6%) (default) | vector in decimals

Reference semiannual yield, specified as the comma-separated pair consisting of 'RefYield' and an N-by-1 vector in decimals.

Data Types: double

'StartDate' — Forward starting date of payments

serial date number

Forward starting date of payments, specified as the comma-separated pair consisting of 'StartDate' and a N-by-1 vector using serial date numbers.

Conversion Factor Calculator

Data Types: double