- X1 Emv Software

- Emv Chip Reader Writer Software

- Emv Software X2 Free

- Work Update..emv Software Download

- Work Update..emv Software Developer

Since April 2020, the new State Strategic Intelligence Team has been working around the clock at the SCC, Victoria's primary control centre for emergency management.

- The solution credit card companies have implemented is to update EMV POS terminals to allow chip cards to be used at any time during the transaction. The card pre-authorizes a temporary amount and retains chip information to send final authorization at the end of the transaction.

- Chip-and-PIN cards generally work just like the checking-account debit cards that have been accepted by merchants for years. At the point of purchase, consumers enter a PIN that connects the payment terminal to the payment processor for real-time transaction verification and approval. Ask your POS software.

X1 Emv Software

| Name | Description | |

|---|---|---|

| 9F01 | Acquirer Identifier | Uniquely identifies the acquirer within each payment system |

| 9F40 | Additional Terminal Capabilities | Indicates the data input and output capabilities of the terminal |

| 81 | Amount, Authorised (Binary) | Authorised amount of the transaction (excluding adjustments) |

| 9F02 | Amount, Authorised (Numeric) | Authorised amount of the transaction (excluding adjustments) |

| 9F04 | Amount, Other (Binary) | Secondary amount associated with the transaction representing a cashback amount |

| 9F03 | Amount, Other (Numeric) | Secondary amount associated with the transaction representing a cashback amount |

| 9F3A | Amount, Reference Currency | Authorised amount expressed in the reference currency |

| 9F26 | Application Cryptogram | Cryptogram returned by the ICC in response of the GENERATE AC command |

| 9F42 | Application Currency Code | Indicates the currency in which the account is managed according to ISO 4217 |

| 9F44 | Application Currency Exponent | Indicates the implied position of the decimal point from the right of the amount represented according to ISO 4217 |

| 9F05 | Application Discretionary Data | Issuer or payment system specified data relating to the application |

| 5F25 | Application Effective Date | Date from which the application may be used |

| 5F24 | Application Expiration Date | Date after which application expires |

| 94 | Application File Locator (AFL) | Indicates the location (SFI, range of records) of the AEFs related to a given application |

| 4F | Application Identifier (AID) – card | Identifies the application as described in ISO/IEC 7816-5 |

| 9F06 | Application Identifier (AID) – terminal | Identifies the application as described in ISO/IEC 7816-5 |

| 82 | Application Interchange Profile | Indicates the capabilities of the card to support specific functions in the application |

| 50 | Application Label | Mnemonic associated with the AID according to ISO/IEC 7816-5 |

| 9F12 | Application Preferred Name | Preferred mnemonic associated with the AID |

| 5A | Application Primary Account Number (PAN) | Valid cardholder account number |

| 5F34 | Application Primary Account Number (PAN) Sequence Number | Identifies and differentiates cards with the same PAN |

| 87 | Application Priority Indicator | Indicates the priority of a given application or group of applications in a directory |

| 9F3B | Application Reference Currency | 1–4 currency codes used between the terminal and the ICC when the Transaction Currency Code is different from the Application Currency Code; each code is 3 digits according to ISO 4217 |

| 9F43 | Application Reference Currency Exponent | Indicates the implied position of the decimal point from the right of the amount, for each of the 1–4 reference currencies represented according to ISO 4217 |

| — | Application Selection Indicator | For an application in the ICC to be supported by an application in the terminal, the Application Selection Indicator indicates whether the associated AID in the terminal must match the AID in the card exactly, including the length of the AID, or only up to the length of the AID in the terminalThere is only one Application Selection Indicator per AID supported by the terminal |

| 61 | Application Template | Contains one or more data objects relevant to an application directory entry according to ISO/IEC 7816-5 |

| 9F36 | Application Transaction Counter (ATC) | Counter maintained by the application in the ICC (incrementing the ATC is managed by the ICC) |

| 9F07 | Application Usage Control | Indicates issuer’s specified restrictions on the geographic usage and services allowed for the application |

| 9F08 | Application Version Number | Version number assigned by the payment system for the application |

| 9F09 | Application Version Number | Version number assigned by the payment system for the application |

| 89 | Authorisation Code | Value generated by the authorisation authority for an approved transaction |

| 8A | Authorisation Response Code | Code that defines the disposition of a message |

| — | Authorisation Response Cryptogram (ARPC) | Cryptogram generated by the issuer and used by the card to verify that the response came from the issuer. |

| 5F54 | Bank Identifier Code (BIC) | Uniquely identifies a bank as defined in ISO 9362. |

| 8C | Card Risk Management Data Object List 1 (CDOL1) | List of data objects (tag and length) to be passed to the ICC in the first GENERATE AC command |

| 8D | Card Risk Management Data Object List 2 (CDOL2) | List of data objects (tag and length) to be passed to the ICC in the second GENERATE AC command |

| — | Card Status Update (CSU) | Contains data sent to the ICC to indicate whether the issuer approves or declines the transaction, and to initiate actions specified by the issuer. Transmitted to the card in Issuer Authentication Data. |

| 5F20 | Cardholder Name | Indicates cardholder name according to ISO 7813 |

| 9F0B | Cardholder Name Extended | Indicates the whole cardholder name when greater than 26 characters using the same coding convention as in ISO 7813 |

| 8E | Cardholder Verification Method (CVM) List | Identifies a method of verification of the cardholder supported by the application |

| 9F34 | Cardholder Verification Method (CVM) Results | Indicates the results of the last CVM performed |

| — | Certification Authority Public Key Check Sum | A check value calculated on the concatenation of all parts of the Certification Authority Public Key (RID, Certification Authority Public Key Index, Certification Authority Public Key Modulus, Certification Authority Public Key Exponent) using SHA-1 |

| — | Certification Authority Public Key Exponent | Value of the exponent part of the Certification Authority Public Key |

| 8F | Certification Authority Public Key Index | Identifies the certification authority’s public key in conjunction with the RID |

| 9F22 | Certification Authority Public Key Index | Identifies the certification authority’s public key in conjunction with the RID |

| — | Certification Authority Public Key Modulus | Value of the modulus part of the Certification Authority Public Key |

| 83 | Command Template | Identifies the data field of a command message |

| 9F27 | Cryptogram Information Data | Indicates the type of cryptogram and the actions to be performed by the terminal |

| 9F45 | Data Authentication Code | An issuer assigned value that is retained by the terminal during the verification process of the Signed Static Application Data |

| 84 | Dedicated File (DF) Name | Identifies the name of the DF as described in ISO/IEC 7816-4 |

| — | Default Dynamic Data Authentication Data Object List (DDOL) | DDOL to be used for constructing the INTERNAL AUTHENTICATE command if the DDOL in the card is not present |

| — | Default Transaction Certificate Data Object List (TDOL) | TDOL to be used for generating the TC Hash Value if the TDOL in the card is not present |

| 9D | Directory Definition File (DDF) Name | Identifies the name of a DF associated with a directory |

| 73 | Directory Discretionary Template | Issuer discretionary part of the directory according to ISO/IEC 7816-5 |

| 9F49 | Dynamic Data Authentication Data Object List (DDOL) | List of data objects (tag and length) to be passed to the ICC in the INTERNAL AUTHENTICATE command |

| 70 | EMV Proprietary Template | Template proprietary to the EMV specification |

| — | Enciphered Personal Identification Number (PIN) Data | Transaction PIN enciphered at the PIN pad for online verification or for offline verification if the PIN pad and IFD are not a single integrated device |

| BF0C | File Control Information (FCI) Issuer Discretionary Data | Issuer discretionary part of the FCI |

| A5 | File Control Information (FCI) Proprietary Template | Identifies the data object proprietary to this specification in the FCI template according to ISO/IEC 7816-4 |

| 6F | File Control Information (FCI) Template | Identifies the FCI template according to ISO/IEC 7816-4 |

| 9F4C | ICC Dynamic Number | Time-variant number generated by the ICC, to be captured by the terminal |

| 9F2D | Integrated Circuit Card (ICC) PIN Encipherment Public Key Certificate | ICC PIN Encipherment Public Key certified by the issuer |

| 9F2E | Integrated Circuit Card (ICC) PIN Encipherment Public Key Exponent | ICC PIN Encipherment Public Key Exponent used for PIN encipherment |

| 9F2F | Integrated Circuit Card (ICC) PIN Encipherment Public Key Remainder | Remaining digits of the ICC PIN Encipherment Public Key Modulus |

| 9F46 | Integrated Circuit Card (ICC) Public Key Certificate | ICC Public Key certified by the issuer |

| 9F47 | Integrated Circuit Card (ICC) Public Key Exponent | ICC Public Key Exponent used for the verification of the Signed Dynamic Application Data |

| 9F48 | Integrated Circuit Card (ICC) Public Key Remainder | Remaining digits of the ICC Public Key Modulus |

| 9F1E | Interface Device (IFD) Serial Number | Unique and permanent serial number assigned to the IFD by the manufacturer |

| 5F53 | International Bank Account Number (IBAN) | Uniquely identifies the account of a customer at a financial institution as defined in ISO 13616. |

| 9F0D | Issuer Action Code – Default | Specifies the issuer’s conditions that cause a transaction to be rejected if it might have been approved online, but the terminal is unable to process the transaction online |

| 9F0E | Issuer Action Code – Denial | Specifies the issuer’s conditions that cause the denial of a transaction without attempt to go online |

| 9F0F | Issuer Action Code – Online | Specifies the issuer’s conditions that cause a transaction to be transmitted online |

| 9F10 | Issuer Application Data | Contains proprietary application data for transmission to the issuer in an online transaction |

| 91 | Issuer Authentication Data | Data sent to the ICC for online issuer authentication |

| 9F11 | Issuer Code Table Index | Indicates the code table according to ISO/IEC 8859 for displaying the Application Preferred Name |

| 5F28 | Issuer Country Code | Indicates the country of the issuer according to ISO 3166 |

| 5F55 | Issuer Country Code (alpha2 format) | Indicates the country of the issuer as defined in ISO 3166 (using a 2 character alphabetic code) |

| 5F56 | Issuer Country Code (alpha3 format) | Indicates the country of the issuer as defined in ISO 3166 (using a 3 character alphabetic code) |

| 42 | Issuer Identification Number (IIN) | The number that identifies the major industry and the card issuer and that forms the first part of the Primary Account Number (PAN) |

| 90 | Issuer Public Key Certificate | Issuer public key certified by a certification authority |

| 9F32 | Issuer Public Key Exponent | Issuer public key exponent used for theverification of the Signed Static Application Data and the ICC Public Key Certificate |

| 92 | Issuer Public Key Remainder | Remaining digits of the Issuer Public Key Modulus |

| 86 | Issuer Script Command | Contains a command for transmission to the ICC |

| 9F18 | Issuer Script Identifier | Identification of the Issuer Script |

| — | Issuer Script Results | Indicates the result of the terminal script processing |

| 71 | Issuer Script Template 1 | Contains proprietary issuer data for transmission to the ICC before the second GENERATE AC command |

| 72 | Issuer Script Template 2 | Contains proprietary issuer data for transmission to the ICC after the second GENERATE AC command |

| 5F50 | Issuer URL | The URL provides the location of the Issuer’s Library Server on the Internet. |

| 5F2D | Language Preference | 1–4 languages stored in order of preference, each represented by 2 alphabetical characters according to ISO 639Note: EMVCo strongly recommends that cards be personalised with data element '5F2D' coded in lowercase, but that terminals accept the data element whether it is coded in upper or lower case. |

| 9F13 | Last Online Application Transaction Counter (ATC) Register | ATC value of the last transaction that went online |

| 9F4D | Log Entry | Provides the SFI of the Transaction Log file and its number of records |

| 9F4F | Log Format | List (in tag and length format) of data objects representing the logged data elements that are passed to the terminal when a transaction log record is read |

| 9F14 | Lower Consecutive Offline Limit | Issuer-specified preference for the maximum number of consecutive offline transactions for this ICC application allowed in a terminal with online capability |

| — | Maximum Target Percentage to be used for Biased Random Selection | Value used in terminal risk management for random transaction selection |

| 9F15 | Merchant Category Code | Classifies the type of business being done by the merchant, represented according to ISO 8583:1993 for Card Acceptor Business Code |

| 9F16 | Merchant Identifier | When concatenated with the Acquirer Identifier, uniquely identifies a given merchant |

| 9F4E | Merchant Name and Location | Indicates the name and location of the merchant |

| — | Message Type | Indicates whether the batch data capture record is a financial record or advice |

| — | Personal Identification Number (PIN) Pad Secret Key | Secret key of a symmetric algorithm used by the PIN pad to encipher the PIN and by the card reader to decipher the PIN if the PIN pad and card reader are not integrated |

| 9F17 | Personal Identification Number (PIN) Try Counter | Number of PIN tries remaining |

| 9F39 | Point-of-Service (POS) Entry Mode | Indicates the method by which the PAN was entered, according to the first two digits of the ISO 8583:1987 POS Entry Mode |

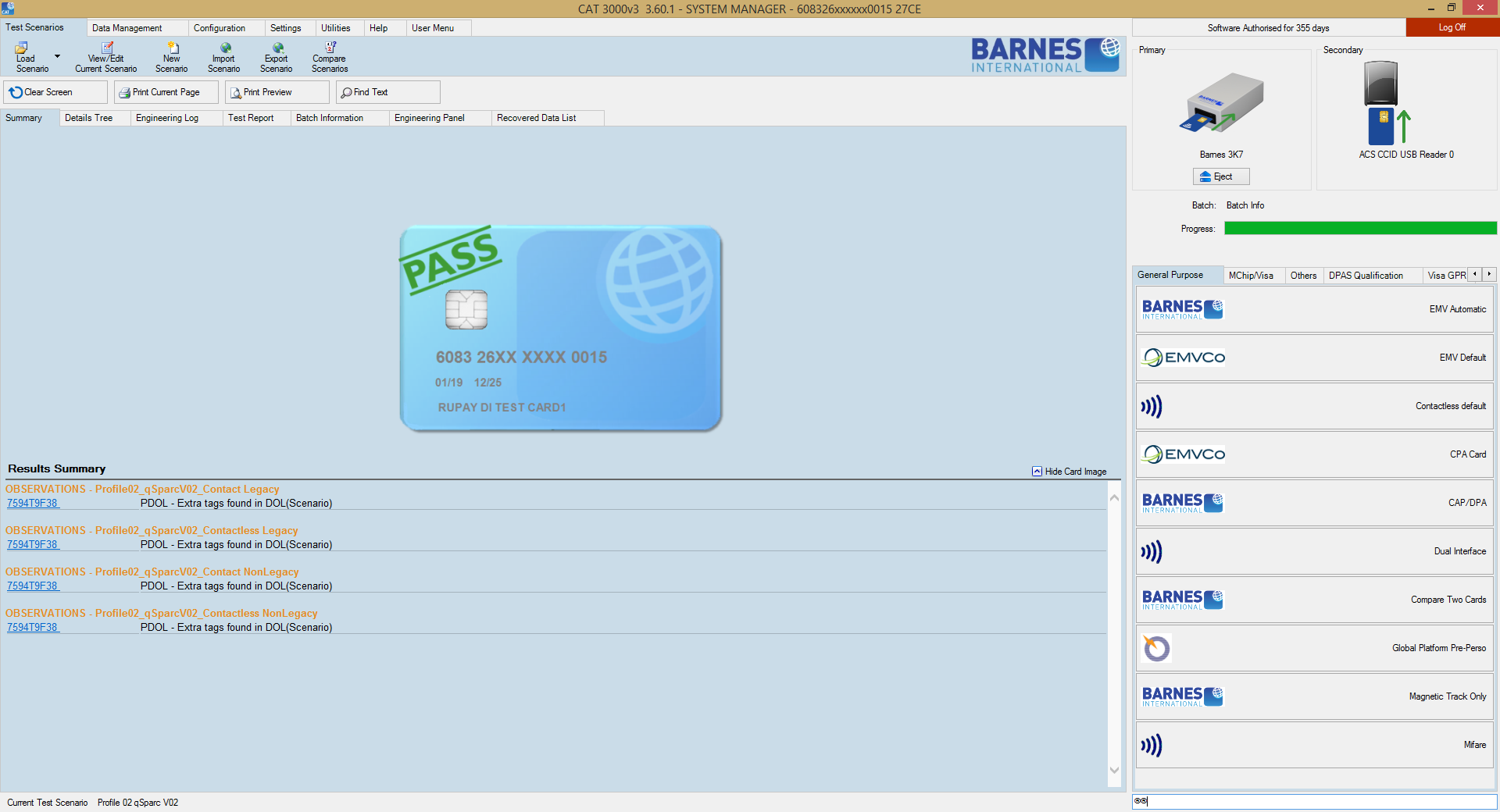

| 9F38 | Processing Options Data Object List (PDOL) | Contains a list of terminal resident data objects (tags and lengths) needed by the ICC in processing the GET PROCESSING OPTIONS command |

| — | Proprietary Authentication Data | Contains issuer data for transmission to the card in the Issuer Authentication Data of an online transaction.For a cryptogram defined by the Common Core Definitions with a Cryptogram Version of '4', the Proprietary Authentication Data element shall be 0 bytes long. The only Cryptogram Version currently defined for the Common Core Definitions is '4'. |

| 80 | Response Message Template Format 1 | Contains the data objects (without tags and lengths) returned by the ICC in response to a command |

| 77 | Response Message Template Format 2 | Contains the data objects (with tags and lengths) returned by the ICC in response to a command |

| 5F30 | Service Code | Service code as defined in ISO/IEC 7813 for track 1 and track 2 |

| 88 | Short File Identifier (SFI) | Identifies the SFI to be used in the commands related to a given AEF or DDF. The SFI data object is a binary field with the three high order bits set to zero. |

| 9F4B | Signed Dynamic Application Data | Digital signature on critical application parameters for DDA or CDA |

| 93 | Signed Static Application Data | Digital signature on critical application parameters for SDA |

| 9F4A | Static Data Authentication Tag List | List of tags of primitive data objects defined in this specification whose value fields are to be included in the Signed Static or Dynamic Application Data |

| — | Target Percentage to be Used for Random Selection | Value used in terminal risk management for random transaction selection |

| — | Terminal Action Code – Default | Specifies the acquirer’s conditions that cause a transaction to be rejected if it might have been approved online, but the terminal is unable to process the transaction online |

| — | Terminal Action Code – Denial | Specifies the acquirer’s conditions that cause the denial of a transaction without attempt to go online |

| — | Terminal Action Code – Online | Specifies the acquirer’s conditions that cause a transaction to be transmitted online |

| 9F33 | Terminal Capabilities | Indicates the card data input, CVM, and security capabilities of the terminal |

| 9F1A | Terminal Country Code | Indicates the country of the terminal, represented according to ISO 3166 |

| 9F1B | Terminal Floor Limit | Indicates the floor limit in the terminal in conjunction with the AID |

| 9F1C | Terminal Identification | Designates the unique location of a terminal at a merchant |

| 9F1D | Terminal Risk Management Data | Application-specific value used by the card for risk management purposes |

| 9F35 | Terminal Type | Indicates the environment of the terminal, its communications capability, and its operational control |

| 95 | Terminal Verification Results | Status of the different functions as seen from the terminal |

| — | Threshold Value for Biased Random Selection | Value used in terminal risk management for random transaction selection |

| 9F1F | Track 1 Discretionary Data | Discretionary part of track 1 according to ISO/IEC 7813 |

| 9F20 | Track 2 Discretionary Data | Discretionary part of track 2 according to ISO/IEC 7813 |

| 57 | Track 2 Equivalent Data | Contains the data elements of track 2 according to ISO/IEC 7813, excluding start sentinel, end sentinel, and Longitudinal Redundancy Check (LRC), as follows:Primary Account Number (n, var. up to 19)Field Separator (Hex 'D') (b)Expiration Date (YYMM) (n 4)Service Code (n 3)Discretionary Data (defined by individual payment systems) (n, var.)Pad with one Hex 'F' if needed to ensure whole bytes (b) |

| — | Transaction Amount | Clearing amount of the transaction, including tips and other adjustments |

| 98 | Transaction Certificate (TC) Hash Value | Result of a hash function specified in Book 2, Annex B3.1 |

| 97 | Transaction Certificate Data Object List (TDOL) | List of data objects (tag and length) to be used by the terminal in generating the TC Hash Value |

| 5F2A | Transaction Currency Code | Indicates the currency code of the transaction according to ISO 4217 |

| 5F36 | Transaction Currency Exponent | Indicates the implied position of the decimal point from the right of the transaction amount represented according to ISO 4217 |

| 9A | Transaction Date | Local date that the transaction was authorised |

| 99 | Transaction Personal Identification Number (PIN) Data | Data entered by the cardholder for the purpose of the PIN verification |

| 9F3C | Transaction Reference Currency Code | Code defining the common currency used by the terminal in case the Transaction Currency Code is different from the Application Currency Code |

| — | Transaction Reference Currency Conversion | Factor used in the conversion from the Transaction Currency Code to the Transaction Reference Currency Code |

| 9F3D | Transaction Reference Currency Exponent | Indicates the implied position of the decimal point from the right of the transaction amount, with the Transaction Reference Currency Code represented according to ISO 4217 |

| 9F41 | Transaction Sequence Counter | Counter maintained by the terminal that is incremented by one for each transaction |

| 9B | Transaction Status Information | Indicates the functions performed in a transaction |

| 9F21 | Transaction Time | Local time that the transaction was authorised |

| 9C | Transaction Type | Indicates the type of financial transaction, represented by the first two digits of ISO 8583:1987 Processing Code |

| 9F37 | Unpredictable Number | Value to provide variability and uniqueness to the generation of a cryptogram |

| 9F23 | Upper Consecutive Offline Limit | Issuer-specified preference for the maximum number of consecutive offline transactions for this ICC application allowed in a terminal without online capability |

https://emvlab.org/ – the one stop site for payment system researchers and practitioners – © 2009–2019

This site is run by Steven Murdoch and hosted by the Information Security Group at University College London. More details about the work we are doing can be found on our information security research blog: Bentham’s Gaze.

EMV® is a registered trademark of EMVCo LLC. This site and its operators are not affiliated or associated with or endorsed by EMVCo. All other trademarks and registered trademarks are the property of their respective owners.

Emv Chip Reader Writer Software

EMV Payment Reports by PYRPTS cover ecommerce, mcommerce, prepaid, mobile wallet, charge cards, debit cards, credit cards, financial cards.

EMV Technology Update: EMV Classic, Faster EMV, and Now QR Code EMV [US-0618-508-MER] CONTENTS

Smart Card Market by Communication (Contact and Contactless), Component (Hardware, Software, and Services), Application (BFSI, Government and Healthcare, Transportation, Retail, and Others) and Geography – Global Forecast to 2023 [GB-0618-163-MAM] CONTENTS

Global EMV POS Terminal Market 2018-2022 [GB-1118-478-THN]CONTENTS

Besides EMV payment reports, PYRPTS Market Research Reports established areas of focus include ecommerce, mcommerce, credit cards, debit cards, prepaid cards, virtual cards, ATMs, kiosks, POS, digital payments, cross-border transactions, EMV, NFC, fraud, factor/device security, cybersecurity, and tokenization/encryption.

PYRPTS Market Research Reports emerging areas of focus include fintech, blockchain, biometrics, cryptocurrency, artificial intelligence, mobile wallets, open banking, alternative payments, P2P, IoT, cybercrime and money laundering.

PYRPTS Partner & Affiliate Network Provides Access to Online and Social Media Channels Focused on Banking and Payments. The spectrum includes an online press release news service, news digest, payments business news, payments consumer news, payments-related blogs, payments research and consulting services, plus daily multichannel Twitter postings.

Emv Software X2 Free

PYRPTS Promotional Services Deliver High Impact and Solid R.O.I. via 3 Service Levels to a Very Targeted Market in Banking, Payments and Financial Services.

PYRPTS is part of Ruebud Media promoting 500+ market research reports backed 100+ years of collective experience in payments, marketing, and broadcasting.

Follow new PYRPTS releases via these Partner/Affiliate Websites and/or Social Media Channels: BankCenter, CardFlash, CardBuzz, CardData, PYRPTS, The RAM Reports, RAM Research, CardTrak, CardSavvy, and CardTweet.

Work Update..emv Software Download

Work Update..emv Software Developer

Monitor New Reports via PYRPTS News.